nebraska vehicle tax calculator

Click here to make an appointment for any driver licensing service including Class O car drive tests. Additional fees collected and their distribution for every motor vehicle registration issued are.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

The highest rate can be found in Gage Countyhome to a high concentration of car owners in the state.

. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660. The average combined sales tax rate for Nebraska is 6324. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Nebraska vehicle tax calculator. Nebraska Income Tax Calculator 2021. While some counties forgo additional costs most will charge a local tax on top of the state rate.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. 1st Street Papillion NE 68046. For example lets say that you want to purchase a new car for 60000 you would use the following formula to calculate the sales tax.

The Nebraska sales tax on cars is 5. Today Nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the overall tax burden for many taxpayers. Nebraska vehicle tax calculator.

If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680. Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E. The state in which you live.

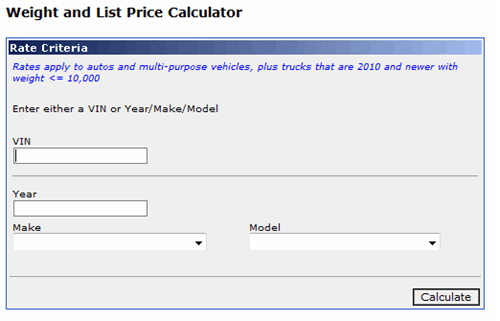

You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. Nebraska Online Vehicle Tax Estimator Gives Citizens Tax. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code.

Faysal bank roshan digital account opening May 7 2022 avengers endgame nano gauntlet toy No Comments. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

Nebraska car tax is 285943 at 700 based on an amount of 40849 combined from the sale price of 39750 plus the doc fee of 299 plus the extended warranty cost of 3500 plus the GAP charge of 1000 minus the trade-in value of 2200 minus the rebate of 1500. Nebraska DMV fees are about 765 on a 39750 vehicle based on a. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services.

Whether or not you have a trade-in. Registering a new 2020 Ford F-150 XL in Omaha. You can find these fees further down on the page.

The statewide sales tax for Nebraska is 55 for any new or used car purchases. The Nebraska sales tax on cars is 5. New car sales tax OR used car sales tax.

60000 x055 3300. NEW - Appointments are now available for ALL driver licensing services permits licenses and State ID Cards at the 17007 Burt Street Service Center in Omaha. The county the vehicle is registered in.

For vehicles that are being rented or leased see see taxation of leases and rentals. If you are registering a motorboat contact the Nebraska Game and Parks Commission. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions.

150 - State Recreation Road Fund - this fee. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV.

This example vehicle is a passenger truck registered in. The type of license plates requested. The state of NE like most other states has a sales tax on car purchases.

How to Calculate Nebraska Sales Tax on a Car. Nebraska Sales Tax on Cars. Montana Salary Calculator 2022.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Here are five additional taxes and fees that go along with a vehicle purchase. Money from this sales tax goes towards a whole host of state-funded projects and programs.

The customary doc fee is 299 in Nebraska but may differ as there is no maximum set by the state. Class O Car drive tests in Lincoln and Bellevue require an appointment. There are no changes to local sales and use tax rates that are effective January 1 2022.

This example vehicle is a passenger truck registered in Omaha purchased for 33585. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tax and Tags Calculator.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

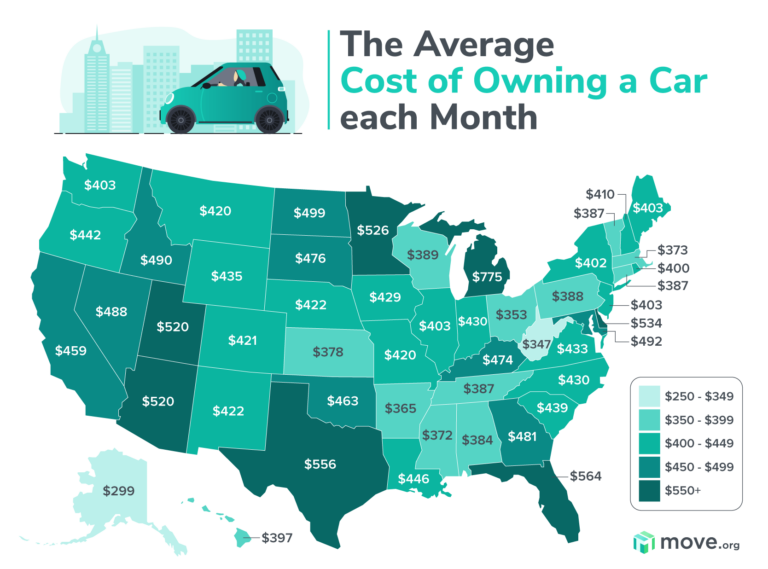

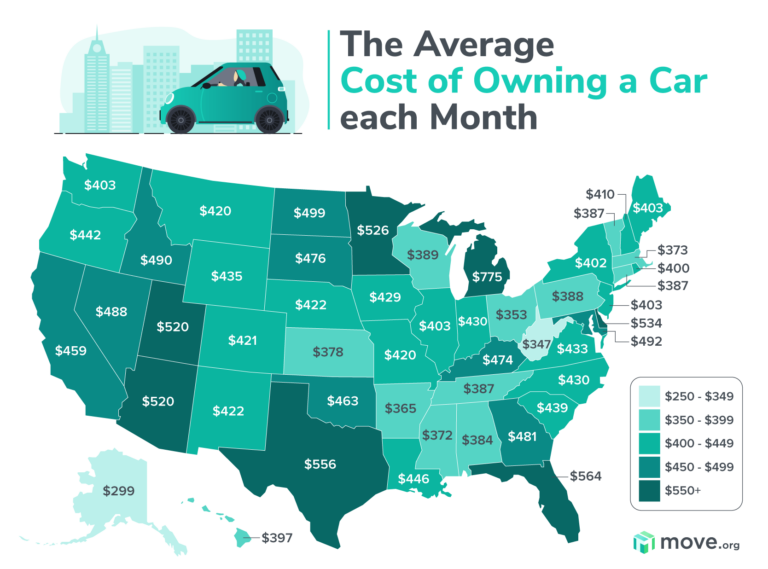

The Average Cost Of Owning A Car In The Us Move Org

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

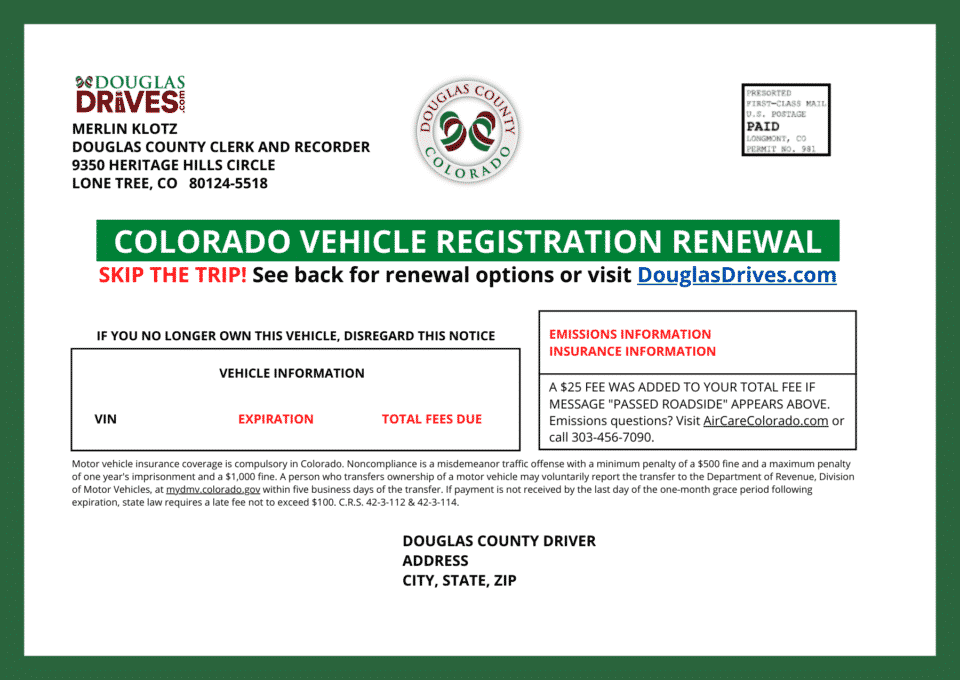

Renew Vehicle Registration License Plates Douglas County

Mazda Indonesia Official Site Mazda Co Id

Which U S States Charge Property Taxes For Cars Mansion Global

Dmv Fees By State Usa Manual Car Registration Calculator

It Is Said That Everyone Can Get A Bad Credit Loan However This Is Not Always True There Are Some People That Can Neve Payday Loans Personal Loans Cash Loans

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Vehicle And Boat Registration Renewal Nebraska Dmv

What S The Car Sales Tax In Each State Find The Best Car Price